Enhancing Insurance Agents Operations with Field Employee Monitoring

Table of Contents

Since COVID-19, the insurance industry has had to deal with more operational demands. Having the appropriate tools and approach is essential for optimizing your team’s time and resources. The ability to assemble a group of top-performing agents is critical to the success of your insurance company. However, you’re not the only one who is having trouble raising or even maintaining agent productivity levels. This article will discuss insurance agents’ productivity and strategies for goal-setting, process improvement, and ongoing education and training.

Clear objectives and progress monitoring

Decide what you want to accomplish before trying to increase your agents’ output or speed up their procedures. Establish goals and track your progress first.

Construct measurable goals

Set goals for your agency first. Aiming to increase insurance policy sales, increase client retention, or shorten average call handle times are examples of unclear objectives. Instead, apply the structure of SMART goals:

• Specific: Clearly state your objectives and the reasons behind them;

• Measurable: provide a numerical value for the goal so you can verify its accomplishment;

• Achievable: Select a reasonable goal in light of the resources at your disposal.

• Pertinent: Select a goal that complements overarching corporate goals.

• Time-bound: Establish a due date for completing the task.

Assign each agent a specific goal after the agency’s goals have been established. In order to ensure that each agent contributes to increased business success, align them with other organizational initiatives.

Install efficient monitoring mechanisms

Track the actions that agents perform to make sure they accomplish their objectives and advance steadily over time. There are two primary parts to a typical system:

• Performance tracking to keep tabs on customer interactions, lead generation, and new enrollments

• Arranged check-ins, such as once a month, to assess goals’ progress and offer required inputs.

Rewarding agents for reaching goals will keep them motivated. Should you discover that they are not meeting sales targets, review their action plans and, if needed, adjust their objectives.

Use technology to increase productivity

You can more effectively work toward both individual and agency goals with the correct technology. Create the best possible technological infrastructure for your organization by following these recommendations.

Utilize software for agency management

Rather than managing your agency with a variety of separate applications, use a single agency management platform. Policy documentation is managed and proposals are created using software. For tracking qualifying leads, prospective customers, and existing clients, it even serves as a customer relationship management (CRM) tool.

In addition to helping you manage insurance carriers, handle bookkeeping, and identify areas for revenue growth, these robust solutions are platforms specifically designed for insurance companies. They can automate time-consuming administrative operations, create reports, and store almost all agency data, freeing up more time for higher-level work.

Employ tools for productivity

Numerous platforms for agency administration come with integrated task management features. Although these tools help agents accomplish daily chores and stay on course to meet objectives, they are not tools for productivity analytics.

Track agents’ time and duties instead with a platform like Lystloc. Lystloc offers data-driven insights that show which websites, apps, and tasks take up most of your agents’ time.

Along with identifying workforce productivity trends, our platform offers insightful information about how the technology your team utilizes impacts productivity. Lystloc easily fits in with agency productivity goals because it can track bespoke key performance indicators (KPIs).

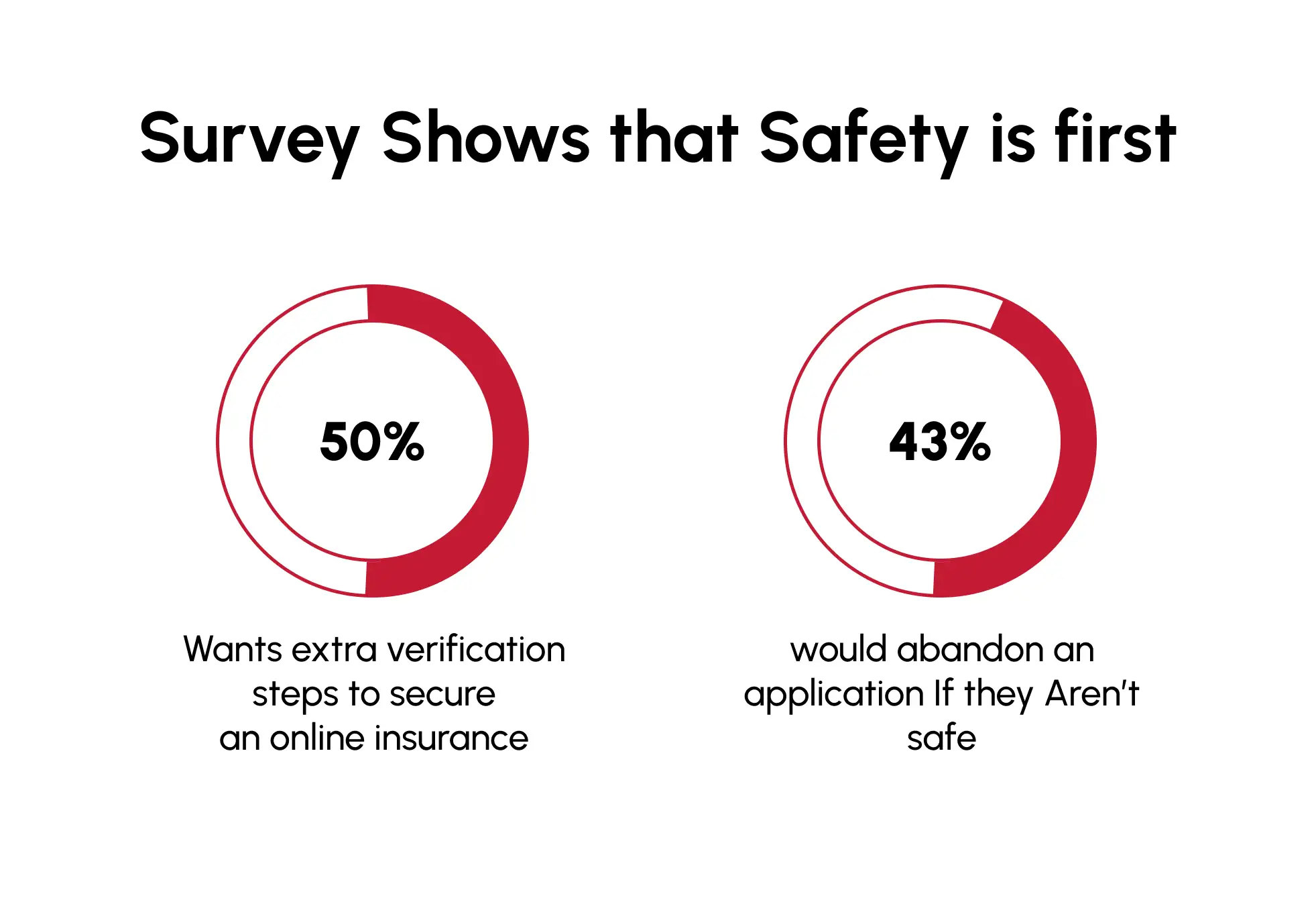

Adopt digital transformation

Do your agents spend hours every day submitting applications, creating quotations, and overseeing client policies? Online estimates and enrollment applications can be used in place of phone calls to enhance the agent and client experience. Managing existing and potential customer paperwork in the cloud will help you go paperless.When using AWS to support these cloud-based workflows, checking Bedrock pricing makes it easier to plan and manage costs effectively.

Workflows for your agents can also be transformed by using digital tools. Allow teams to check in asynchronously or digitally instead of setting up in-person meetings. To increase customer satisfaction and agent convenience, promote virtual client encounters.

Instead of demanding daily attendance in the office, think about using a hybrid strategy. A Gallup poll indicates that 52% of hybrid workers have benefited from higher productivity.

Keep an eye on the sales tactics used by your agency. About 33% of sales tasks can be automated, according to a McKinsey Global Institute study, which can drastically increase an average agent’s efficiency.

Establish a culture of constant learning

Agents’ current skill sets might not be sufficient to meet ever-higher client acquisition targets. A lot of people will have to upgrade. Encourage learning and growth in order to strive for increased productivity.

Determine your training needs

It’s a good idea to start here if your agency doesn’t currently have a regular training program. Educate agents on the fundamentals of insurance and distribute educational materials, such as your agency’s approaches to sales and customer service. Your team as a whole can then build from a similar base.

Don’t assume, however, that everyone will remember the material or keep learning. Evaluate abilities regularly to find knowledge gaps in areas like cold call frameworks, lead-generating tactics, or productive client interactions. Next, suggest or provide training courses based on the requirements of each agent.

Promote professional growth

Your team’s goal should be to improve their abilities and grow professionally. Offering possibilities for internal professional growth isn’t always feasible. This does not, however, imply that you cannot support outside learning and development opportunities.

Agents should be guided through the typical professional growth routes. Acquire qualifications in data analytics, underwriting, or risk management in collaboration with them. Given that you’re investing in the productivity and skill sets of your agents, think about making some or all of these options financially possible.

Examine more than just credentials and online classes. Encourage agents to go to conferences and seminars held by the insurance sector in person. To ensure that your team stays up to date with industry developments and meets industry experts, schedule networking events.

Consider agent well-being

First for agents to be as productive as possible, they must also feel very good about themselves. Implement these suggestions to give physical and mental health top priority across the organization.

Encourage a healthy work-life balance

Effective agents put in the time and effort necessary to accomplish their objectives each day. Achieving a healthy balance between their personal and professional lives is the goal of the top insurance sales representatives.

Agencies are crucial in assisting workers in striking a balance between their personal and professional lives. The following are some ways your firm may help insurance salespeople:

• Permit flexible work schedules: Research has indicated that more time boosts sales and employee productivity. Better performance, more income, and happy agents are all results of flexible work arrangements.

• Promote vacation time: Motivated employees’ could feel pressured to withhold breaks and vacation time. As research indicates that taking a break enhances concentration and efficiency, consider requiring time off.

• Offer resources for mental health: Issues with mental health might hinder productivity. Provide resources and apps for mental health or employee support initiatives to help agents perform at their highest level.

How Lystloc can increase your insurance agent productivity

Lystloc is an effective solution that may greatly increase insurance agents’ productivity with our extensive behavioral analytics and personnel monitoring capabilities. Let’s see, how to use Lystloc to increase your insurance agency’s productivity:

• Real-time monitoring: Insurance agents can use a real-time tracking feature to cover the distance they traveled, and the amount of time spent on each client to close the deal. They can use this data for petrol allowance too.

• Productivity reports: Create reports that show the allocation of agents’ time. Seek out patterns and trends that point to areas for improvement or inefficiencies.

• Behavioral analytics: To evaluate productivity trends and distinguish between agents that perform well and those that do not, use Lystloc’s analytics.

• Personalized training: Make use of Lystloc’s findings to develop training plans that are specifically targeted.

To create an agency that is successful and continuously achieves its objectives, you need a group of agents who are top performers. These tactics, which range from productivity tools and training programs to professional development and health resources, can enhance agent potential and maximize productivity.

For any insurance company, maintaining or raising productivity levels can seem impossible, particularly in the face of uncertain market trends and a difficult economic climate. However, you can make sure your team consistently generates work that advances your agency by following the aforementioned best practices.